All Categories

Featured

Table of Contents

At the end of the day you are acquiring an insurance coverage product. We like the protection that insurance uses, which can be obtained much less expensively from an affordable term life insurance coverage policy. Unsettled finances from the plan may additionally reduce your survivor benefit, reducing another degree of defense in the policy.

The idea only functions when you not just pay the considerable costs, yet use extra cash money to purchase paid-up enhancements. The possibility cost of every one of those bucks is remarkable extremely so when you could rather be purchasing a Roth IRA, HSA, or 401(k). Also when contrasted to a taxed investment account and even a financial savings account, limitless banking might not supply equivalent returns (compared to investing) and similar liquidity, accessibility, and low/no cost framework (contrasted to a high-yield interest-bearing accounts).

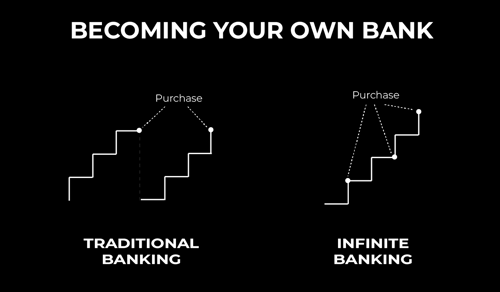

When it involves economic planning, entire life insurance policy frequently stands out as a preferred choice. Nonetheless, there's been a growing trend of marketing it as a device for "unlimited financial." If you have actually been checking out whole life insurance policy or have actually stumbled upon this concept, you could have been informed that it can be a method to "become your own bank." While the concept could seem appealing, it's important to dig much deeper to comprehend what this really implies and why seeing entire life insurance in this way can be misleading.

The idea of "being your own bank" is appealing since it recommends a high degree of control over your funds. Nonetheless, this control can be illusory. Insurance provider have the supreme say in just how your plan is managed, including the regards to the fundings and the rates of return on your cash worth.

If you're considering whole life insurance, it's essential to view it in a wider context. Entire life insurance can be a useful tool for estate planning, providing a guaranteed survivor benefit to your recipients and possibly using tax benefits. It can also be a forced savings lorry for those who struggle to conserve money regularly.

It's a kind of insurance coverage with a savings component. While it can offer constant, low-risk growth of cash value, the returns are generally reduced than what you might accomplish with various other financial investment vehicles (infinite banking review). Before delving into whole life insurance policy with the idea of boundless banking in mind, take the time to consider your financial objectives, risk tolerance, and the complete range of monetary products offered to you

Emirates Islamic Bank Skywards Infinite Card

Unlimited financial is not a monetary panacea. While it can work in certain scenarios, it's not without risks, and it calls for a considerable commitment and comprehending to handle successfully. By recognizing the possible pitfalls and recognizing real nature of entire life insurance policy, you'll be better equipped to make an enlightened choice that supports your monetary health.

This publication will teach you how to set up a banking plan and how to use the financial plan to invest in realty.

Unlimited banking is not a service or product offered by a specific institution. Unlimited financial is a strategy in which you purchase a life insurance policy plan that gathers interest-earning cash money worth and secure finances versus it, "borrowing from yourself" as a source of funding. Then ultimately repay the funding and begin the cycle all over once again.

Pay policy costs, a portion of which develops cash worth. Cash money value earns worsening interest. Take a car loan out versus the policy's cash value, tax-free. Pay back fundings with rate of interest. Cash value gathers once again, and the cycle repeats. If you use this principle as meant, you're taking money out of your life insurance policy to purchase every little thing you would certainly need for the remainder of your life.

The are entire life insurance policy and global life insurance policy. The cash money worth is not added to the death benefit.

The plan funding rate of interest price is 6%. Going this course, the interest he pays goes back into his plan's cash money worth rather of a financial institution.

Infinite Banking Canada

The principle of Infinite Financial was produced by Nelson Nash in the 1980s. Nash was a financing professional and follower of the Austrian school of business economics, which promotes that the value of goods aren't explicitly the outcome of conventional financial frameworks like supply and need. Rather, people value cash and products in different ways based on their economic status and requirements.

One of the challenges of typical financial, according to Nash, was high-interest prices on car loans. Long as banks established the interest rates and loan terms, people didn't have control over their very own riches.

Infinite Financial requires you to possess your economic future. For goal-oriented individuals, it can be the finest monetary tool ever. Below are the advantages of Infinite Banking: Arguably the solitary most advantageous aspect of Infinite Financial is that it improves your money flow.

Dividend-paying entire life insurance policy is very low danger and uses you, the insurance holder, a large amount of control. The control that Infinite Financial uses can best be organized into 2 classifications: tax obligation benefits and possession defenses. Among the factors whole life insurance policy is excellent for Infinite Financial is just how it's tired.

When you use whole life insurance for Infinite Financial, you enter right into a private contract in between you and your insurance policy firm. These defenses may differ from state to state, they can consist of protection from possession searches and seizures, defense from reasonings and security from financial institutions.

Whole life insurance coverage plans are non-correlated possessions. This is why they work so well as the economic structure of Infinite Financial. No matter of what takes place in the market (stock, real estate, or otherwise), your insurance coverage policy maintains its well worth.

Infinite Banking Nash

Market-based financial investments grow wide range much quicker but are subjected to market fluctuations, making them naturally risky. Suppose there were a third pail that offered safety and security but also modest, guaranteed returns? Whole life insurance policy is that third container. Not just is the price of return on your whole life insurance policy policy guaranteed, your fatality advantage and costs are also assured.

Here are its primary advantages: Liquidity and ease of access: Plan finances offer prompt access to funds without the restrictions of traditional financial institution lendings. Tax performance: The money value expands tax-deferred, and plan car loans are tax-free, making it a tax-efficient tool for constructing wealth.

Asset security: In numerous states, the cash value of life insurance policy is shielded from creditors, adding an extra layer of economic safety. While Infinite Financial has its values, it isn't a one-size-fits-all remedy, and it includes significant disadvantages. Below's why it might not be the very best approach: Infinite Financial typically needs detailed policy structuring, which can puzzle insurance policy holders.

Visualize never ever needing to bother with bank financings or high rates of interest once more. What if you could obtain cash on your terms and develop wealth simultaneously? That's the power of unlimited financial life insurance. By leveraging the cash money value of whole life insurance policy IUL policies, you can grow your wealth and obtain money without depending on typical banks.

There's no set lending term, and you have the liberty to select the repayment schedule, which can be as leisurely as repaying the finance at the time of fatality. This flexibility reaches the servicing of the financings, where you can select interest-only repayments, keeping the lending equilibrium level and manageable.

Holding money in an IUL repaired account being credited rate of interest can commonly be much better than holding the money on down payment at a bank.: You've constantly desired for opening your very own bakeshop. You can obtain from your IUL plan to cover the first costs of renting a room, buying devices, and employing staff.

Infinite Banking Illustration

Personal finances can be gotten from standard banks and lending institution. Below are some key points to think about. Bank card can offer a flexible means to obtain money for very temporary durations. Borrowing money on a credit scores card is usually extremely costly with yearly portion prices of rate of interest (APR) commonly getting to 20% to 30% or more a year.

The tax obligation treatment of policy fundings can differ substantially depending upon your nation of home and the certain regards to your IUL plan. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, policy lendings are usually tax-free, using a significant benefit. Nonetheless, in various other territories, there may be tax implications to take into consideration, such as potential tax obligations on the funding.

Term life insurance policy just offers a fatality benefit, without any type of cash money value accumulation. This means there's no money value to borrow versus.

For funding officers, the comprehensive laws imposed by the CFPB can be seen as troublesome and limiting. Initially, lending officers frequently say that the CFPB's guidelines create unnecessary red tape, causing more paperwork and slower loan processing. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) needs, while focused on shielding consumers, can lead to hold-ups in shutting offers and raised functional prices.

Latest Posts

Infinite Banking Scam

Infinite Wealth And Income Strategy

Be Your Own Bank Whole Life Insurance